Thailand’s economy faces mounting risks in 2025 as growth slows to 2.5% in 2024. Experts warn of weak investment, lower export growth and looming US tariffs. The Bank of Thailand may cut rates to counter a sluggish outlook, but tough choices lie ahead.

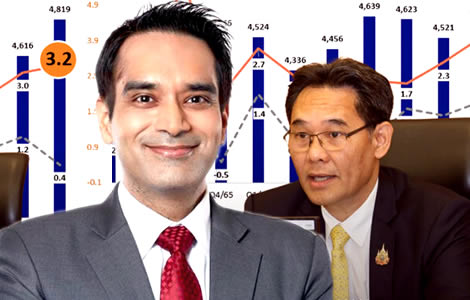

A top Bangkok-based analyst has warned that Thailand may face an economic uphill struggle in the second half of 2025. Amonthep Chawala, the Chief Economist of CIMB Thai Bank, suggested that the Bank of Thailand may signal a rate cut at its next meeting or keep its powder dry for headwinds to come. This comes following confirmation on Monday that the economy only grew 2.5% in 2024, while projected growth for 2025 was reduced to 2.8%. At the same time, the kingdom is facing almost certain jeopardy from United States retaliatory tariffs, which President Trump has already set in motion. On Monday, Secretary-General of the National Economic and Social Development Council (NESDC) Danucha Pichayanan confirmed that growth has slowed in the last quarter of 2024. Particularly worrying are potential threats to the country’s critical foreign tourism sector at this time.

Thailand’s National Economic and Social Development Council (NESDC) on Monday confirmed reports that economic growth slowed in the last quarter of 2024. In short, GDP growth in the final quarter of 2024 came in at 3.2%, compared to the 3.9% projected by the latest Reuters Poll of economic experts.

It is unclear what happened, but key culprits appear to be reduced private investment and consumption growth. Additionally, although tourism for the year was up 26%, growth seemed limited in the last month.

Rising unemployment and shorter working hours put pressure on Thailand’s manufacturing sector in 2024

Meanwhile, the country’s manufacturing sector is being decimated with more workers on shorter working hours and rising unemployment. This trend was already evident in the first six months of 2024. At the end of June, 457,000 workers were on part-time contracts, compared to 412,000 in 2023.

The figures were presented on Monday by the National Economic and Social Development Council (NESDC) Secretary-General, Danucha Pichayanan.

Mr. Danucha emphasized how dependent the economy in 2025 will be on foreign tourism. At the same time, he warned that Thailand needs to address significant challenges in that industry, including a serious air pollution problem with PM2.5 levels rising in key areas.

In addition, he emphasized that the government needs to be proactive regarding security concerns, especially with a threat looming over the Chinese tourism market following widespread anger in China over perceptions that Thailand was linked to international scam centres.

Thailand’s 2025 Growth Outlook lowered as economic body warns of deep-rooted structural challenges

Mr. Danucha predicted that Thailand’s economy would grow by between 2.3% to 3.3% in 2025, with a median growth forecast of 2.8%. Undeniably, this is substantially lower than previous government forecasts.

Significantly, the top economist warned that these projections were based on sustained export growth, increased investment, consumption and government investment programs.

Officials at the state’s main advisory body also noted Thailand’s list of structural problems. These include not only significantly high household debt but also widespread borrowing in the business sector. Additionally, the country’s ageing population and lower education standards are impeding growth.

For instance, a recent English proficiency index listed Thailand as 10th in the world, although it ranked 8th in the ASEAN community. Certainly, the country is losing ground to Singapore and the Philippines, where English is more widely spoken. The ability of the workforce to speak English is a key requirement for Western firms looking to invest.

Government urged to accelerate infrastructure spending to boost sluggish economic growth in 2025

Nevertheless, Thailand must succeed in attracting both increased foreign capital flows and private sector investment. Meanwhile, Mr. Danucha urged the government to expedite public infrastructure spending to reach at least 75% disbursement in 2025.

Certainly, these are minimum requirements to achieve the modest growth target outlined. The economic body also revised Thailand’s GDP growth for 2023 upward from 1.9% to 2%.

Earlier, it was thought that growth for 2024 would be 2.7%. Monday’s news confirms that despite growth in foreign tourism, the economy remains sluggish and weak.

Furthermore, as the country heads into 2025, it faces significant downside risks.

Some analysts based in Bangkok have suggested that the Monetary Policy Committee of the Bank of Thailand may consider a rate cut at its next meeting scheduled for February 26th, 2025. It is expected that the central bank will, at least, signal an interest rate cut even if it hold rates steady at this time.

Meanwhile, US President Donald Trump signed an executive order last week invoking Section 238 of the 1930 Trade Act. In brief, this means that Thailand can expect retaliatory US tariffs soon, with a 30-day notice window.

Thailand braces for trade war impact as new tariffs from US and China take effect in early 2025

At the end of last week, Pichai Naripthaphan, the ebullient Minister of Commerce official who recently returned from Washington DC, suggested that the kingdom hopes to avoid such a scenario. However, with a massive $35.4 billion surplus with the United States in 2024, this seems unlikely.

Indications from both the Commerce Minister and Pichai Chunhavajira, his Finance Minister counterpart, suggest that Thailand is prepared to negotiate, possibly by reducing Thai tariffs on US imports.

In the meantime, China’s 10% tariff increase on February 3rd is now in effect. Furthermore, additional countermeasures were enacted on February 10th. Unfortunately, this escalated trade war will damage Thailand’s exports.

Over the weekend, Bank of Thailand Governor Sethaput Suthiwartnarueput warned that the fallout from an aggressive global trade war could severely impact the country’s export performance in 2025.

Therefore, for now, the government is in a wait-and-see mode. Certainly, any new US tariff regime may begin to affect Thailand’s performance in May or June 2025.

Economic concerns mount as Thailand’s manufacturing and property sectors face ongoing decline in 2025

Speaking to reporters on Monday, the Head of Research for CIMB Thai Bank, Mr. Amonthep Chawala, expressed concern for the kingdom’s economic outlook. Not only is manufacturing output continuously declining, but so is the property sector’s output.

In addition, capital remains in short supply as banks reduce their loan books. Nevertheless, Mr. Amonthep underscored one reassuring aspect: Thailand’s financial sector and economy are stable despite these challenges.

Foreign tourism continues to grow with a 22% increase in numbers in January 2025. However, the analyst cautioned that even this crucial engine has its limits. He also expressed reservations about surpassing the 39.8 million foreign tourist arrivals seen in 2019. In 2024, the figure was 35.5 million.

Mr. Amonthep particularly highlighted concerns about the decline seen in the country’s automobile industry. 2024 was a disastrous year for the industry, with production totalling 1.467 million vehicles, down a staggering 19.9%. Car sales fared even worse, plummeting by 26.2%. Even electric vehicle (EV) sales in 2024 dropped 5.77% following a 320% boom in sales the previous year.

Bank of Thailand faces tough choices as economic slowdown pressures interest rate policy in 2025

On Monday, the CIMB Bank economist expressed apprehension about the kingdom’s economic prospects in the latter half of 2025. He predicted that the Bank of Thailand would take action to lower interest rates sooner rather than later.

However, he cautioned that the central bank may choose to hold off to preserve its options in case of greater risks later in 2025.

Thailand waits on new Trump retaliatory trade tariffs to be launched within hours from the White House

Hopes dashed as the Thai economy sputtered in the 4th quarter of 2024. Only 2.5% growth now expected

Certainly, this places the central bank in a tight spot as interest rates in the US may firm due to Trump’s aggressive trade policies, potentially leading to a higher inflation threat.

“We see it as difficult for the Thai economy to grow by 3% this year unless the government introduces strong stimulus measures. We still project the economy to grow by 2.7% and anticipate a gradual slowdown quarter-on-quarter throughout the rest of this year,” he said. “While the Bank of Thailand may be playing catch-up, it needs to consider the uncertainty in the global financial market, especially from trade barriers that will become more severe in the second half of the year. Essentially, the central bank may want to retain the ability to implement policies effectively in the latter part of the year. In other words, cutting interest rates more clearly when the economy slows down is possible.”

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Trump Presidency already having a heavy impact on Thailand even before he talks trade with Bangkok

Trump Presidency already having a heavy impact on Thailand even before he talks trade with Bangkok

Economy sees sharp setback with lower private spending, investment and foreign tourism income

Trump’s trifecta triumph means Thailand will be more on edge as he prepares to take power in January

Ung Ing congratulates Trump as Thailand uneasily confronts the meaning of his second Presidency