China’s plans to reflate its economy lift global markets, sparking rallies in Chinese stocks and boosting the Thai baht. However, analysts warn that without clearer policies, the world’s second-largest economy may still miss growth targets amid its ongoing property slump.

Signals from Beijing this week that it plans to stimulate the Chinese economy have spurred markets. In effect, the plan is to reflate the world’s second-largest economy from the effects of a property slump. Certainly, the reports have buoyed markets there. Indeed, the good news has spread to world markets and, in particular, helped power the rise of the Thai baht. However, given the scale of China’s economy in 2024 and the intractable nature of the property slump, the scale of what is required is vast. At this time, the politburo has not clarified the details of its plan. Furthermore, the initiative stems from weaker economic data, suggesting targets this year will be missed without intervention.

China’s latest vow to boost its economy has brought a wave of optimism to global markets, including a notable impact on the Thai baht. This week, Beijing intensified its efforts to counteract its ongoing economic struggles, particularly in the property sector.

The Chinese government is seeking to stabilise the economy, using targeted fiscal support rather than relying on massive infrastructure projects, as seen in the past. Instead, the new strategy aims to directly put money in consumers’ pockets.

China’s Economic struggles prompt urgent action

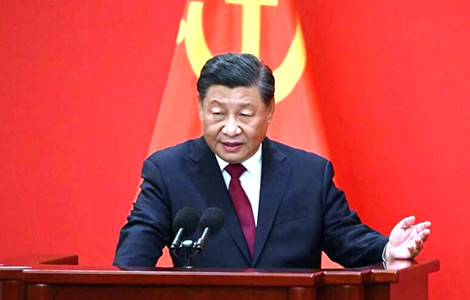

China’s leaders, headed by President Xi Jinping, have promised to ramp up fiscal and monetary policies to reinvigorate the world’s second-largest economy.

The country has been struggling with a severe property crisis and rising deflationary pressures. Economists and analysts have increasingly warned that China is in danger of missing its official economic growth targets for the year, prompting the politburo to act.

On Thursday, the politburo pledged to “issue and use” government bonds to enhance public investment, signalling a significant fiscal intervention. The timing of the politburo’s announcement is also significant.

September sessions are unusual, reflecting a heightened sense of urgency about the deflation risks facing China.

While the announcement boosted market confidence, some experts believe that China has yet to reach a “whatever it takes” moment in addressing its economic issues. Morgan Stanley analysts suggested that more aggressive actions might be necessary to fully revive the economy.

Markets rally on news of Fiscal Stimulus

News of the government’s fiscal plans sparked a surge in Chinese markets. China’s CSI 300 stock index climbed by 4.3% on Thursday, pushing it into positive territory for the year.

The Hang Seng Mainland Properties Index, tracking Chinese property developers in Hong Kong, surged by 16%.

These gains reflect investors’ renewed confidence that China is committed to stabilising its economy through government-backed measures.

The positive sentiment extended beyond China. European stock markets saw gains, with the Stoxx 600 index rising 1%, and major indices in Frankfurt and Paris up by over 1%. This rally was driven by the exposure of Europe’s automotive and luxury sectors to the Chinese market. Meanwhile, U.S. markets also opened higher, with the S&P 500 increasing by 0.7% and the Nasdaq Composite rising by 1.3%.

China’s Property market and the need for further action

This latest round of fiscal support follows a series of measures announced earlier in the week by the People’s Bank of China.

These included interest rate cuts and billions of dollars aimed at supporting the stock market through share buybacks and other financial mechanisms. The measures were also designed to alleviate stress on China’s beleaguered property market, which has been a significant drag on the country’s economic growth.

Despite the flurry of government actions, China has so far refrained from launching a major fiscal stimulus package like those seen in previous crises. For example, in 2008, China injected 4 trillion yuan ($570 billion) into the economy, which had a substantial impact on global markets.

Weak consumer demand in China. Call by former central bank boss Yi to fight a severe deflationary spiral

Strong money inflows drive baht upwards. Business leaders warn it is time for urgent central bank action

Today, economists estimate that to achieve a similar effect, China would need to spend up to 10 trillion yuan over the next two years, with a focus on consumer spending rather than infrastructure.

The shift in focus from large-scale industrial projects to consumer-driven demand marks a new approach for China. Rather than building new bridges and roads, the government is looking to stimulate domestic consumption, which has been weak due to the property slump and ongoing concerns about the broader economy.

Deflationary concerns and the risk of Economic decline

Economists have raised concerns about China’s potential slide into a deflationary spiral. As the property market continues to struggle, domestic consumption remains stagnant, which is leading to weak demand and falling prices.

This economic trend is placing additional pressure on policymakers to act more decisively.

“A proper reflation of the Chinese economy would involve either a much weaker currency or very aggressive fiscal stimulus,” said Homin Lee, a senior macro strategist at Lombard Odier.

China’s government appears to be favouring fiscal stimulus as the main tool for reinvigorating the economy, though the size and scope of these measures remain uncertain.

Promises of property market stabilisation and growth

During the politburo meeting, China’s leaders also made promises to provide more support to property developers and homeowners. In effect, they aim to stabilise the real estate market. They emphasised the importance of preventing further declines in the sector and restoring confidence in the market.

Additionally, policymakers highlighted the need to promote consumption and increase wages, particularly for the middle class and low-income earners. Encouraging foreign investment in manufacturing was another key point. Certainly, China seeks to maintain its role as a global manufacturing hub.

Employment remains a central concern for Chinese leaders. Members stressed the importance of ensuring job opportunities for vulnerable groups, including college graduates and migrant workers. In recent years, China has worked to lift millions out of poverty, but the current economic challenges threaten to undo much of this progress.

Global implications of China’s economic policy

As China takes steps to stabilise its economy, the ripple effects are being felt worldwide. The global economy, heavily reliant on Chinese demand, stands to benefit from the country’s renewed fiscal efforts.

In Southeast Asia, including Thailand, China’s moves have already helped lift currencies and markets. The Thai baht, for example, has seen a significant appreciation this week, partly due to China’s economic stimulus measures.

China’s latest moves are seen as a positive step toward economic recovery. Nonetheless, many analysts believe that more aggressive actions will be needed in the coming months.

China’s ability to effectively reflate its economy will have major implications. Not just for its domestic markets but undoubtedly for the global economy as well. Failure could quicken the loss of confidence in financial markets. At the same time, success would buoy confidence in prospects for the wider world economy’s. Make no mistake however, this is fraught with risk.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Disturbing questions that must be confronted over Thailand’s reeling economy are China and EV cars

First-quarter GDP growth surprises analysts based on higher tourism and consumer spending growth

Central bank holds interest rates. Economy will grow 2.6% in 2024 as Srettha pushes home ownership

Economy unlikely to grow in first quarter as Thai manufacturing crumbles. Hard choices ahead

New Finance Minister expected in April as economic malaise deepens with downgrades in GDP growth