China’s economic woes drive investors to ASEAN bloc countries, with Thailand struggling at under 3% growth until 2034. As Foreign Direct Investment shifts away from China, Vietnam and the Philippines emerge as key beneficiaries.

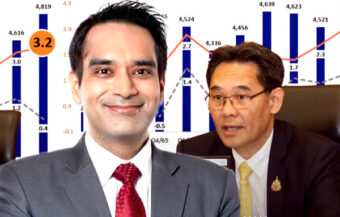

A recent report authored by international consultancy Bain and Co suggests Thailand’s growth potential will remain below 3% until 2034. In short, it holds that the country will not benefit from inward investment as much as younger economies such as Vietnam and the Philippines. The analysis highlights how Foreign Direct Investment has now reversed course in relation to China. For example, in 2023, the six nations in the bloc, including Thailand, attracted nearly five times more inward capital than China. This comes with increasingly disturbing news from the Communist country, where President Xi Jinping’s authoritarian rule has almost wiped out international investor confidence. In particular, one key finding may hold out some hope for Thailand. That is that inward investment is increasingly looking for cheaper and greener energy sources rather than just lower labour costs. Indeed, it is something that has been prioritised by Prime Minister Srettha Thavisin.

Undoubtedly, what happens in China impacts the economy in Thailand. Indeed, both countries are combating similar types of problems. For instance, demographic challenges and an ageing workforce are key factors impeding growth in both countries. Similarly, politics are impeding both economies, driving down Foreign Direct Investment.

In China, the authoritarianism introduced since President Xi Jinping took power has severely weakened its economy. The Chinese leader has shown little respect for free market forces, thereby eroding investor confidence in his country.

China’s weakening economy and rising industrial unrest after investor confidence has plummeted below zero

At the same time, a worsening property sector in China poses a real threat to the country’s financial stability.

In addition, it is presently reporting a surge in labour and industrial disputes. In short, China’s population, is still smouldering from the abusive actions by authorities during China’s 2022 Covid crackdown.

The outbreak of industrial unrest shows that the population is increasingly unhappy. Indeed, this explains the exodus of Chinese people with capital from the country in recent years.

In the meantime, it has lost the confidence of the international investment community. In essence, the Chinese dream has stalled. Foreign firms and investors are now looking at Southeast Asia.

A striking report published in Singapore this month by DBS Bank Ltd and the American consultancy Bain and Co. predicts that inward investment over the next decade will be focused on Southeast Asia and the ASEAN bloc.

Indeed, the report finds that economic growth in the region will see ASEAN outperform China, even though the world’s second-largest economy will remain about 4-5 times the size of the bloc.

Economic growth in ASEAN driven by trade war as pandemic shock sees foreign investment shift from China

In effect, ASEAN is driven by six countries, including Thailand, Singapore, Malaysia, Vietnam, Indonesia, and the Philippines. Essentially, the key driver is the US-China trade war.

In addition, the economic shock caused by the pandemic has set off an exodus of economic investment and opportunity out of China.

In the meantime, there is serious concern about not only future growth within the Chinese economy but also its existing fundamentals.

Indeed, a key aspect of concerns relating to China is the lack of transparency from Beijing and scepticism about its economic data. The Communist country certainly has ongoing and as yet undefined problems within its property sector. Indeed, no one is certain how deep the hole is. In short, it has begun to damage Chinese private wealth holders. In turn, this has seen a cratering of consumer confidence.

Thailand’s economic growth stymied as report urges shift from Cheap Labour to Green Energy Investment

Meanwhile, the possibility of investment flowing to Southeast Asia is significant.

However, unfortunately for Thailand, the report sees its growth over this extended period as continuing to be stymied.

However, it does emphasise key aspects of Prime Minister Srettha Thavisin’s approach since taking office. It highlights that attracting Foreign Direct Investment by holding out the prospect of cheap labour will not be enough going forward.

The Bain and Co report identifies cheaper, green energy as a key priority.

Another key aspect of the report is how the region’s relationship with China is changing. Certainly, the northern partner to the Regional Comprehensive Economic Partnership (RCEP) will remain a huge market. However, it will further grow as an investor in ASEAN countries.

ASEAN countries face growing challenges from China’s increasing influence and protectionist tendencies

At this time, the region’s largest investor is the United States, with $37 billion invested. This is followed by Japan with $27 billion.

Of course, this may change as ASEAN countries move towards increased protectionism against China, which has been dumping cheap output across its markets, particularly in the last year.

Undoubtedly, there are growing questions over exactly what is happening in China. A recent move by Beijing’s security services to silence one of its top journalists, former Global Times editor Hu Xijin, is the latest sinister development.

All these acts, including the forced disappearance of Alibaba founder Jack Ma some time ago, are linked to the economy. Undoubtedly, this particularly spooks markets and investors.

Ten-member ASEAN bloc outpaces China in foreign investment as global decoupling accelerates pace

Therefore, it should not be surprising to see that in 2023, the ASEAN bloc pulled far ahead of China in relation to Foreign Direct Investment. The region’s six economies attracted up to $200 billion in investment funds compared to $42 billion for China.

Furthermore, there is currently a massive outflow of investment and production out of China as the decoupling between it and Western economies moves into higher gear.

Thailand changes tack as EV revolution turns into a damp squib with warehouses full of unsold cars

Lack of coherence in government policy is the root cause of Thailand’s massive economic problems

Disturbing questions that must be confronted over Thailand’s reeling economy are China and EV cars

However, Thailand does not find itself well-placed to benefit from the investment flow into the ASEAN bloc. Firstly, the main problem is the ageing workforce. After that, there are problems with education levels, corruption, and political instability.

Thailand and Singapore face slow growth while Vietnam and the Philippines emerge as investment magnets

The report highlights both Vietnam and the Philippines as beneficiaries of the current trend. These two economies are expected to grow by 6.6% and 6.1% respectively from 2024-2034.

In the meantime, Thailand alongside Singapore has a projected growth rate at the bottom of the table. Over the next decade, the international consultancy sees growth rates of less than 3%.

Significantly also, the report predicts that China will become the ASEAN bloc’s biggest investor at the same time.

In effect, it suggests that Chinese firms expanding offshore will invest more than the United States and Japan.

Charles Ormiston is the Chairman of the Angsana Council, a non-profit organisation promoting economic development in Southeast Asia.

“It’s not just foreign investors in China, but Chinese investors themselves are also looking to move their businesses overseas to avoid tax restrictions and security concerns,” he explained.

China remains dominant in the ASEAN region despite ongoing economic uncertainties and data manipulation

Meanwhile, the report’s authors underlined that China will remain the dominant economy and market in the region.

Over the next 10 years, up to 2034, its GDP is expected to reach $21 trillion.

Notably, this will still be six times the ASEAN bloc’s six main economies combined, including Thailand. In terms of the bloc overall, it will be 4.3 times.

However, a word of caution: China has become both unpredictable and less respectful of free market forces.

Therefore, the communist country is no longer seen as an attractive investment prospect. Indeed, in the third quarter of 2023, China’s State Administration for Foreign Exchange (SAFE) confirmed that foreign direct investment (FDI) had turned negative.

For instance, for the whole of 2023, it was only $42 billion. In brief, that was only 0.2% of reported GDP. The figure was a fall of 77% from 2022 and 87.5% down from 2021 when it reached $344 billion.

Concerns are rising about Chinese data integrity and economic transparency amid domestic challenges

In addition, there is rising concern about anomalies in Chinese economic data. These have been referred to by respected academics and even the U.S. State Department.

In essence, it appears that Chinese data could be trusted when the economy was growing well. However, not when experiencing internal problems such as the country’s local banking and property crisis.

Data anomalies have been discovered in recent statistics. These have been attributed to manipulation by local Communist Party officials. Indeed, some research suggests that Chinese growth in past years and decades may have been overstated by as much as 65%.

The Chinese data, when analysed by comparing official data to estimated data, shows the second-largest differential worldwide. The only economy with a bigger differential is war-torn Burma.

In that country, the junta is operating a closed financial system that artificially overvalues the distressed country’s currency. As a result, a black market has grown up relying on dollars and trade outside the failing economic system.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Thailand changes tack as EV revolution turns into a damp squib with warehouses full of unsold cars

Top Thai insurer says no more new policies for EV cars. Later, it emphasised renewals case by case

Lack of coherence in government policy is the root cause of Thailand’s massive economic problems

Disturbing questions that must be confronted over Thailand’s reeling economy are China and EV cars

First-quarter GDP growth surprises analysts based on higher tourism and consumer spending growth

Central bank holds interest rates. Economy will grow 2.6% in 2024 as Srettha pushes home ownership

Economy unlikely to grow in first quarter as Thai manufacturing crumbles. Hard choices ahead

New Finance Minister expected in April as economic malaise deepens with downgrades in GDP growth