The danger of a credit downgrade for Thailand is growing as private sector debt continues to creep up, and even with interest rates at only 2.5%, the effects on the economy are already significant, with the property market down by over 14% with up to 20% fewer properties sold.

The rift between the Thai government and the Bank of Thailand continues to widen as the country’s economy treads water with a prospect of a possible credit downgrade driven by elevated public and private sector debt levels and the absence of direction. It comes as the government’s economic policy, such as the controversial Digital Wallet scheme to ignite growth, is seen to be at odds with a campaign being launched in 2024 by the Bank of Thailand to rein in private sector borrowing and, in particular, resolve credit demand driven by an element of the population living beyond its means.

As the economy stumbles to the end of 2023 with a projected 2% decline in exports and a figure for foreign arrivals for the year at 27 million, the projection for annual GDP growth is somewhat the same as last year at 2.6 to 2.7%. It is quite a disappointing outcome.

In this situation, one of the critical drivers of the country’s economic misfortune this year has been the worldwide rising cost of borrowing money, with the Bank of Thailand finally relenting and allowing five interest rate increases between March and September 2023.

Steady rise in interest rates in Thailand, albeit to only half the level of other countries, is already causing a significant downturn in property sales

Nonetheless, interest rates in Thailand are only 2.5%, under half the 5.5% baseline rate in the United States and similar rates in Southeast Asian countries such as Malaysia, which has a borrowing rate of 5.425%.

The current worldwide trend in interest rates has left the Bank of Thailand in an invidious position as it attempts to keep the economic recovery on track. In contrast, Thai borrowers have been put to the pin of their collar even on comparatively lower interest rates.

For instance, this week, a borrower with a loan on a property explained that after making a payment of ฿10,900 at her local bank, she saw only ฿5.5 taken off the principal owed because of the elevated interest rate.

Thailand’s spiralling household debt rate is the highest for developing countries and even well ahead of the United States and the United Kingdom rates

The Bank of Thailand has yet to release up-to-date figures for the total household debt, but in the first quarter of 2023, it had already reached 90.7% of GDP, rising sharply from 87% at the end of 2022.

In context, the Bank for International Settlements recommends a ceiling value for household debt for countries at 80%.

This leaves Thailand with the most enormous household debt in the developing world and an outlier in Asia, compared to Malaysia at 73.1%, Japan at 67.6%, China at 61.6%, Singapore at 58.3%, India at 37.1% and Indonesia at only 17.3%.

The Thai level of household debt is substantially ahead of that in the United Kingdom, which is at 86.4%, and the United States at 78%.

Both the latter countries have substantially larger economies than Thailand and GDP per capita at multiple times the Thai level, with substantial savings and investments held by the public within the banking system.

Plan put forward by the Bank of Thailand to deal with private sector debt will become a significant headwind to GDP growth driven by loan expansion

The pressure being put on the central bank comes as it implements a plan, outlined in July 2023, to rein in household debt from January 1st 2024, with even more draconian and pronounced measures coming into play in April 2024, targeting persistently revolving debt-clogging up the country’s financial arteries and economic growth.

Bank of Thailand to tackle household debt in new plan from 2024, which will see higher standards

Potential hazard lights flashing as kingdom’s auto loans spiral into default with sky-high borrowing

Measures include a cap on interest rates for specific borrowers to provide for restructuring while also moving decisively to move bank customers towards reducing their debt burdens and dissuading borrowers who repeatedly renew loans.

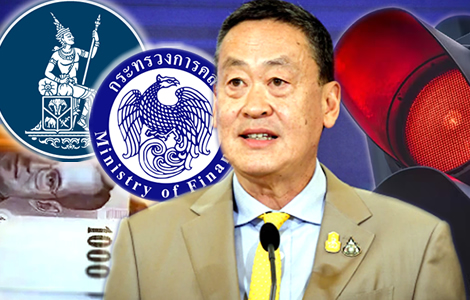

Consequently, the Bank of Thailand’s direction appears to conflict with the new government’s economic policies led by Srettha Thavisin’s pro-growth agenda. Mr Srettha is also the kingdom’s finance minister.

Pheu Thai-led government is pushing ahead with an expansionary economic policy aimed at a targeted annual growth rate of 5% not seen since 2012

Nevertheless, the Pheu Thai-led government appears intent on implementing the party’s expansionary policies, pursuing annual GDP growth of 5% per annum, something that most analysts in Thailand and, indeed, bankers think may not be possible for the country in the medium term given a range of chronic underlying ailments.

The kingdom last saw such a growth rate in 2012, with a GDP gain of 7.2%. The highest rate since then was 4.2% in 2017 and 2018, with growth declining by 6.1% in 2020 with growth no higher than 2.6% since.

Sobering news for new Pheu Thai ministers as the economic growth rate continues to weaken

Thailand’s days of GDP growth above 5% may be a thing of the past as it has grown too old

Additionally, tensions between the Bank of Thailand and the government have taken hold. They are growing as the bank is also becoming concerned at the level of public debt as the government’s borrowing to GDP level has reached 61.6% with a borrowing ceiling under the State Fiscal and Financial Disciplines Act 2018 extended by the previous government of 70%.

Rising bad loan rates across the board put pressure on the Bank of Thailand, leaving it at odds with the government’s pro-growth economic policies

The projected scenario for the year ahead, with weaker global economic prospects and chronic internal problems as Thailand comes to terms with its already extended and highly leveraged level of household debt, is causing tensions between the government and the central bank.

In addition to the stricter policy on lending being imposed on financial institutions from the beginning of next year, the National Credit Bureau is reporting disturbing figures concerning non-performing loans and special mention loans, with reports that there is ฿1.09 trillion in borrowings at present unresponsive among the ฿13.6 trillion advanced by the country’s leading financial institutions.

This represents an effective non-performing loan rate of 8%.

At the beginning of the year, the National Credit Bureau warned of a deteriorating situation for auto and revolving personal loans. Still, this has now extended to the property sector as more borrowers struggle to meet repayments on loans taken out over the last decade at low-interest rates.

Property market to decline by over 14%

Vichai Viratkapan, the Director-general of the Real Estate Information Center (REIC), estimates that in 2023, the number of residential units transferred or sold will decrease by 19.2%, with the value of transactions reduced by 14.1% to ฿915 billion based on 317,485 units being moved.

‘The effects of these interest hikes impact homebuyers across all price ranges, with a clearer impact on individuals with lower or middle-income levels, potentially delaying their purchasing decisions,’ he said.

Another critical point is that National Credit Bureau data shows that 55.44% of all loans through significant financial institutions are property and automobile loans, with a total amount outstanding of ฿4.93 trillion on housing loans and ฿2.61 trillion on auto loans.

Digital Wallet scheme to spur economic growth has become embroiled in confusion and controversy as well as a touchstone for opposition to the government

Furthermore, the credit agency revealed that in the third quarter of 2023, the total amount outstanding in loans among key financial institutions was at ฿13.6 trillion, up by 3.8% from 2022.

The campaign, initiated on January 1st 2024, will impede economic growth next year. It is another potential headwind for the government as it tries to coordinate and process its flailing Digital Wallet scheme, an online financial giveaway using blockchain technology instead of hard cash.

The government’s signature project is encountering resistance within the country’s financial and official sectors, not least because of its ฿400 to ฿500 billion price tag, which will require increased public borrowing.

It has also become a touchstone for rising opposition and criticism of the coalition government sworn in on September 5th.

Questions are being raised over the fundamental legality of the proposal and the ability of the government to finance it through orthodox funding mechanisms.

The Assistant Governor of the Bank of Thailand who supervises financial institutions is Ms Suwannee Jatsadasak.

New regulations on bank lending come into force in 2024, including debt service ratios and a ban on aggressive advertising terms and interventions

She explains that the new requirements for financial institutions beginning next year will preclude them from aggressively marketing financial products or using terms such as ‘instant loans’ or ‘no collateral needed’.

The emphasis from the beginning of next year will be on responsible lending and informing the public to create a more financially aware population.

The problem for the Thai economy is that many people who borrow money on a persistent and revolving basis are simply not earning enough income to pay their way every month and have learned to resort to multiple loan sources and revolving credit facilities.

In essence, a large segment of the Thai population ‘is robbing Peter to pay Paul’, to use a centuries-old Western banking expression.

The new campaign to be launched by the Bank of Thailand will impose new debt service ratios on financial institutions, which should undoubtedly slow down loan growth and the dynamism within the economy in the short term.

Household debt has increased from just 53% of GDP in 2010 to 90.7% of GDP in the first quarters of 2023, much of it secured on property and auto loans

It is the opposite of what the Pheu Thai government wants to see happening.

Figures released by the Puey Ungphakorn Institute for Economic Research in March last year show that only a minority of the Thai public is, in fact, in debt, with 24% of people aged 20-35 taking on loans compared to 20% of those between 36 and 60 and 11% of those over 60.

Much of the country’s household debt is tied up in agricultural loans, which are constantly revolving, supported by title deeds to farmers’ lands as security held by the country’s banks, particularly the specialist banks such as the Bank for Agriculture and Agricultural Cooperatives (BAAC) and the Government Savings Bank.

In the 13 years since 2010, Thailand’s level of household debt has increased by 53% from 59.3% that year to a figure of 90.7% at the end of the first quarter this year. This figure may have increased even further.

Nonetheless, only 37% of the country’s overall adult population has financial debt, but this must be compared to 30% six years ago in 2017.

57% of borrowers owe less than ฿1 million

Many of these debts are smaller amounts, with 57% of borrowers owing between ฿100,000 and ฿1 million, while only 14% have debt over ฿1 million.

The average debt per borrower in Thailand works out at ฿520,000, mostly linked with loans in the agriculture and farming sectors. An added complication to efforts by the Bank of Thailand to remedy the situation is extended debt moratoriums from the pandemic era, which have, to some extent, created a moral hazard and weakened the repayment discipline among the borrowing public.

The challenge facing the Bank of Thailand and the government is the danger of a credit downgrade for Thailand and capital outflows from the country, which may precipitate a more rapid increase in the borrowing rate within the economy.

Such a development could internally precipitate some financial crisis within the banking system, with the Bank of Thailand making it clear at this point that financial stability in the kingdom can no longer be taken for granted.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Economy is in troubled waters with fears for both exports and foreign tourism as 2023 winds down

Thailand faces an economic future of low growth despite Srettha’s plans because of a darker world

Another dip for the baht or are economic danger signals flashing for both Thailand and the world?

Police chief confirms 2 dead with reports of at least one more fatality in Bangkok mass shooting

Bank of Thailand boss appears critical of the new government’s policy initiatives on the economy

Concerns over household debt rising as banks report marginally lower non-performing loans

Thailand preparing for a soft landing as ‘cracks’ open up in the Chinese economy says bank chief

Economic danger signals emerging as politicians wrangle over who will form the next government

Bank of Thailand to tackle household debt in new plan from 2024 which will see higher standards

Politicians skating on thin ice as the economy may not be able to withstand a political stalemate

Debt crisis may be one of the top items on the new cabinet’s agenda as central bank stands ready

Potential hazard lights flashing as kingdom’s auto loans spiral into default with sky-high borrowing

Bank of Thailand governor gives veiled warning to voters on the danger posed by populist policies

Financial markets debt sell-off sending a signal to Thailand before the May 14th General Election