Thailand’s property market faces a sharp decline with transactions down 25% in 2024. Yet, Bangkok sees record land prices of up to ฿4 million per square wah. However, economic uncertainty is making owners reluctant to sell, leading to cautious market activity.

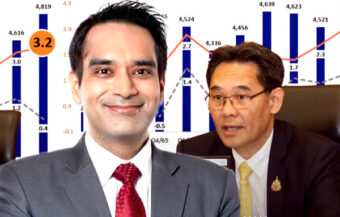

Thailand’s property sector is in trouble as growth in the wider economy continues to be constrained. Meanwhile, the country is facing economic headwinds which have seen the Bangkok Stock Exchange fall by over 15% since this time last year. Figures published on Thursday last by leading Bangkok firm Colliers showed property transactions in Thailand were down by over 25% in the first 10 months of 2024. Despite this, property in central areas of Bangkok commands record prices. However, a peculiar phenomenon has emerged both here and on a wider scale in Thailand. Sellers are reluctant to part with property assets as economic uncertainty rises.

Thailand’s property market is showing signs of a two-tier economy. It comes as prices for prime property and land in the centre of the capital hold up. However, nationwide in the kingdom, it is quite a different story. New research published on Thursday by leading property firm Colliers certainly is an eye-opener.

In short, it reveals the value of property transactions across Thailand fell by 25.27% between January and October 2024. At length, the total transaction value was ฿582.47 billion, down from ฿779.5 billion in the same period of 2023.

Thailand sees lowest property transaction levels in 15 years as the economy faces financial headwinds

This marks the lowest level of transactions seen in 15 years. The sharp decline has been attributed to Thailand’s sluggish economic growth and growing financial headwinds.

Experts predict the property sector will continue to weaken if economic conditions do not improve. In addition, growing signs of political instability in Thailand do not help the outlook.

At the same time, the Stock Exchange of Thailand (SET) is down 16.17% so far in 2025. Indeed, it is 15.32% below its value last year. Despite the national decline, prime property in Bangkok’s central areas remains resilient.

Land prices in the capital have soared to as high as ฿4 million per square wah. Areas along electric train extensions and city centres continue to attract developer interest.

Prime Bangkok land sees record prices but sellers hesitant as economic uncertainty rises

However, buyers are surprisingly reluctant to sell.

Consequently, negotiations are slow and complex. “This year, land trading is still bustling, mostly in areas around the city centre or along the electric train extensions. Developers are focusing on low-rise projects or affordable condominiums,” said Mr. Phattarachai Taweewong, Director of Research and Communications at Colliers International Thailand.

In contrast to the rest of Thailand, it is a buyer’s market for prime development land. Undeniably, in Bangkok’s high-demand areas, transactions are taking longer to finalise.

Some land plots in busy commercial districts and key economic zones have asking prices exceeding ฿4 million per square wah.

Despite high costs, developers are still prepared to invest if the land holds potential. Popular districts like Lang Suan, Silom, Sathorn, and Sukhumvit have seen continued increases in both sales and rental prices.

Bangkok land prices surge after Australian Embassy sale in 2022 drove inner city market value increases

After the high-profile sale of the Australian Embassy land at an average of ฿1.45 million per square wah in 2022, prices in nearby zones surged.

Some plots have sold for over ฿2 million per square wah. In Sukhumvit, prices have climbed by about 10% annually. Thonglor has recorded land prices exceeding ฿2.86 million per square wah, setting new records.

Elsewhere along Sukhumvit Road, plots are commanding between ฿2.5 and ฿2.9 million per square wah. In Silom-Sathorn, prices range from ฿2 to ฿2.5 million per square wah. Yet, many owners of prime land are now reluctant to sell.

In short, they sense potential long-term gains. “If it is prime land, where the price is still increasing, owners are hesitant to sell. They are looking for other income-generating options,” said Mr. Phattarachai.

Cautious owners seek joint ventures and leasing amid fears of long-term economic instability going forward

These options include renting, leasing, or forming joint investment ventures. The trend reflects a cautious approach, as owners view property as a stable asset in uncertain times.

This situation highlights Thailand’s two-tier economy. Bangkok remains home to some of the world’s wealthiest people and continues to attract new residents.

Economy faces a liquidity crisis as the property and manufacturing sectors nosedive impeding growth

Property market glut sees minister’s call for support in the face of the central bank’s ongoing credit crunch

In contrast, other regions face challenges, with sluggish property sales. At the same time, even there, owners are hesitant to sell at low prices due to liquidity concerns. The market, as with the wider economy, seems assailed by uncertainty and a lack of security.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Economy faces a liquidity crisis as the property and manufacturing sectors nosedive impeding growth

New tax era in Thailand begins as Revenue now shares data with 138 countries within the OECD

Calls for clarification of new Tax regime which appears to target expat foreign income sources

10 year visa a magnet for global citizens setting up in Thailand with zero tax on offshore income

Wealthy foreigners to own small landholdings associated with homes here agreed in principle

New plan for the Thai economy could see an elite foreign visa scheme generate up to 6% of GDP

Economic plan to put the smile back in Thailand’s appeal to western foreigners to live and work

IMF urges government to loosen nation’s purse strings as finances tighten with the tax take down

Plan to allow high tech and skilled foreigners to live and work in Thailand for up to four years