PM Paetongtarn urged to secure key trade deals, with a focus on a US-Thai pact. As Trump’s tariffs loom, Thailand must deal with global economic threats and reduce its overreliance on China, aiming for stability through strategic partnerships and robust trade agreements.

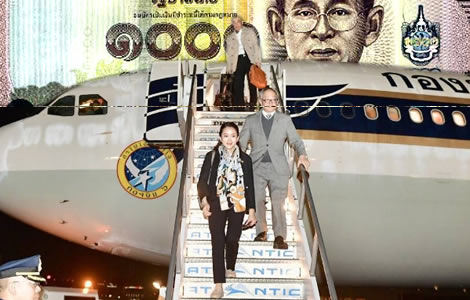

Prime Minister Paetongtarn Shinawatra attended the APEC summit in Lima, Peru, this week, focusing on navigating Thailand’s global position amid growing economic pressures.

During the visit, she was accompanied by top ministers, including Mr. Pichai Naripthaphan, the Minister of Commerce.

The Thai baht closed on Saturday at ฿34.84 to the US dollar, marking a 7.6% decline since late September. Deputy Finance Minister Paophum Rojanasakul described this level as “acceptable,” noting a 2.8% depreciation since January. However, deeper economic challenges remain.

Typically, the baht strengthens at year-end, but global factors have reversed this trend. U.S. President-elect Donald Trump’s protectionist policies are among the key concerns.

New tariffs and protectionist moves could significantly disrupt Thailand’s export economy and trade relations

Proposed tariffs, including a 20% general import tariff and a 60% levy on Chinese imports, could disrupt Thailand’s exports. The U.S., accounting for 17% of Thailand’s output, is its largest trading partner.

Thailand relies heavily on trade, with exports contributing 65.4% of its GDP. While a weaker baht boosts short-term exports, the overall outlook is concerning.

Weakened domestic demand, declining property sales, and falling car sales highlight economic malaise. Bangkok’s residential property sales fell 26.6% in the first quarter, while car sales dropped 27% so far this year, reflecting a lack of liquidity in the country.

The Trump administration’s return raises additional worries for export-reliant economies like Thailand. Rule of Origin (ROO) provisions in future trade agreements are a particularly challenging prospect. These rules, requiring local content thresholds, could reach 40% or higher. For instance, the Trump negotiated 2018 United States-Mexico-Canada Agreement (USMCA) imposed a 75% ROO on automotive imports.

Proposed Rule of Origin provisions in trade deals could limit Thailand’s role as a key manufacturing hub

Such restrictions could discourage manufacturers from using Thailand as a production hub for U.S.-bound goods, hurting its appeal as an investment and export hub. Recognising these risks, Paetongtarn’s government must aim to secure new trade deals.

At the APEC summit, the prime minister sought to forge partnerships to offset potential trade losses. A U.S.-Vietnam free trade agreement highlights the urgency for Thailand to secure its own bilateral pact with the U.S. Without such a deal, Thailand risks losing investment and export opportunities to its regional neighbour.

Simultaneously, Thailand is pursuing a free trade agreement with the European Union, which could boost GDP by 1.28% annually.

However, negotiations are challenging, requiring compliance with stringent EU demands on climate, labour, and procurement. Experts stress the importance of diversifying trade partnerships to reduce reliance on the U.S. and China.

Currency fluctuations add to Thailand’s challenges. Analysts warn of renewed volatility, with the baht identified as one of Asia’s most vulnerable currencies to Trump’s policies.

Thailand’s export-driven economy faces major risks from Trump’s tariffs causing regional currency volatility

Trump’s tariffs will likely impact Asia broadly, hitting export-reliant countries like Thailand and Taiwan the hardest. The Thai baht and Taiwanese dollar appear sensitive to these trade challenges and soaring U.S.-China tensions.

Conversely, economies such as India and the Philippines, with less dependence on exports to China, are better positioned. At the same time, on a trade-weighted basis, Bloomberg sees the Chinese yuan as the region’s most inflated currency. Certainly, the yuan is very closely linked with the baht.

Amid global uncertainty, the Thai government is working to strengthen domestic resilience.

October saw slight growth in consumer sentiment, supported by recovering tourism and stimulus measures. However, sustaining momentum requires addressing household debt and revitalising industries.

Thailand’s government is focused on strengthening domestic demand amid global trade threats

Thailand faces regional competition, especially within ASEAN. Neighbouring countries have imposed tariffs and bans on Chinese imports to counter market distortions.

Trump’s trifecta triumph means Thailand will be more on edge as he prepares to take power in January

Trade chief Robert Lighthizer asked to take up role by Trump as Thailand has 13th largest deficit worldwide

Commerce Ministry bullish about exports under Trump but ‘America First’ surely spells challenges for Thailand

Thailand’s cautious approach reflects its balancing act between protecting industries and maintaining trade ties with China. In short, China exerts a strong influence in Bangkok.

At this critical juncture, however, Thailand must navigate complex economic and geopolitical dynamics.

Securing robust trade agreements, especially one with the U.S., is crucial.

These deals may require significant concessions, such as stricter environmental and labour compliance. In addition, they may require concession to Thailand’s prohibitive 1999 Foreign Business Act.

In turn, this would require more political stability and a unified government with purpose.

Business leaders urge action from PM Paetongtarn

Thailand’s ability to thrive in a protectionist world depends on bold action and economic resilience. Prime Minister Paetongtarn’s efforts to establish stable partnerships and simultaneously promote sustainable growth will define Thailand’s future.