Former US President Donald Trump’s potential return to the Oval Office threatens further damage to the baht, Thai economy, and money markets. It raises concerns about a stronger dollar and increased capital flight from Thailand even in the short term.

Former US President Donald Trump took a big step forward on Thursday night in Atlanta, Georgia. In short, all of a sudden, the prospect of another unpredictable Trump presidency has come closer. Undoubtedly, this poses challenges for Thailand’s economy, which has been ripped apart by the collapse in the global economic system Trump initiated in his first term. Certainly, already in the aftermath of the first debate, there are concerns about a stronger dollar and rising capital flight from Thailand.

Thursday night’s Presidential debate in the United States has exacerbated concerns for the Thai economy and, in particular, the value of the Thai baht. It has also given Thai policymakers another potential headache or ball to juggle.

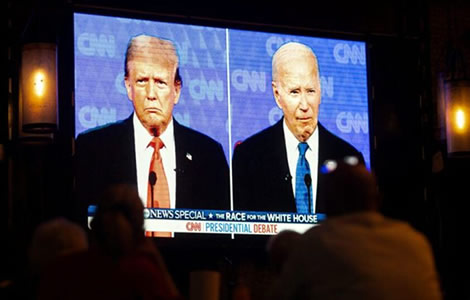

The face-off, televised nationally, saw what analysts have described unanimously as a ‘disastrous’ performance by incumbent President Joe Biden.

Indeed, PredictIt, a New Zealand-based prediction service, raised its odds of a Trump victory from 55% to 61% after the 90-minute debate hosted by CNN.

For Thailand, however, the prospect of a Trump presidency may not be good news. In short, it is likely to lead to both a stronger US dollar and a deepening of the trade war with China.

On Friday, Kasikorn Research Centre predicted that the Thai baht will shortly breach the ฿37 against the US dollar. It comes despite rising tourist numbers

Both are key factors underlying the country’s declining or low-growth economy since 2018.

On Friday, Kasikorn Research Centre predicted that the baht will reach ฿37 to the dollar in the months to come. Significantly, the baht is presently far lower than it was this time last year.

Baht falls even after the Bank of Thailand’s intervention. It has lost 8.8% of its value in 2024 so far

This time last year, the dollar was at ฿35.56 to the baht compared to Friday’s close at ฿36.73.

That is a 3.25% increase for the dollar. Certainly, it is normal for the baht to rise against the dollar in the second half of the year as foreign tourist numbers increase, particularly in the High Season period beginning in November.

This figure comes even as foreign tourists to Thailand were up 36% in June compared to last year. However, analysts question the expenditure figure attributed to these tourists this week of ฿795 billion. The kingdom welcomed 16.84 million visitors.

Presently, the target for the year is 36 million.

Surprise drop in manufacturing output in May was a jolt to the markets which had thought a pickup in April signalled at least a medium-term recovery pattern

However, the real concern is the growing lack of confidence in Thailand’s economy.

For example, on Friday the country revealed a surprise 1.54% drop in manufacturing for May. This was driven by a downturn in the auto industry. Production in this sector was down 16.2% last month.

Certainly, one key reason for this is a tough line by the Bank of Thailand in reining in credit and consequently lower purchasing power for Thais.

However, there is also growing concern about the disruption to car manufacturing in Thailand caused by the EV market. In itself, the sales of all-electric cars have run into hurdles leaving buyers wary in both Thailand and export markets.

The drop in the Manufacturing Production Index (MPI) ran counter to a Reuters poll which predicted a 1.35% rise. In addition, it followed a 2.69% rise in the manufacturing index in April, the first in 19 months.

Previously, many analysts had pointed to local factors such as the hot weather and increased manufacture of air conditioners as a reason for that bump.

Capital flight sees foreign sellers in both the stocks and bond markets while smaller-scale foreign and additionally, local investors are changing tack

Capital flight from Thailand is occurring in share sales, bond sales, and among smaller inward investors due to the country’s new foreign taxation drive.

In the meantime, capital has been flowing out of Thailand. This is occurring in both stock and bond markets as well as among smaller investors.

Significantly, there are reports that Thailand’s change in its tax laws, which effectively taxes remittances by both foreigners and Thais, is playing a part in what is looking like a fundamental shift. In effect, both foreigners and Thais are reorganising their affairs.

Unquestionably, this means curtailing remittances to Thailand and using offshore accounts. In addition, because of the new law relating to worldwide taxation, wealthier foreign residents plan to alter their circumstances.

Changes announced by the Revenue Department have smashed the perception of Thailand as a haven for financial assets. In essence, a casual tax haven

This comes despite an expectation that the new laws will be further clarified by the Revenue Department.

Presently, the two regulations introduced in 2023 and announcements from senior Revenue officials have sown concern.

Undoubtedly, it has to be admitted that Thailand was, up to the end of 2023, a safe haven for financial assets.

In effect, the kingdom was a casual tax haven for foreigners.

Indeed, the previous government marketed Thailand to foreign workers and investors because of its friendly tax policies.

At the same time, it should come as no surprise to Thai authorities that such a fundamental shift will similarly see a counter effect.

Thai government urged to act to preserve the country’s auto industry which is fighting for survival

Thai taxman now plans to tax foreigners on all income whether it is remitted to the kingdom or not under global tax rule

Undoubtedly, the change to the tax laws announced last September and in particular a new worldwide tax regime being pursued by the Revenue Department at the same time is certainly changing the perception of Thailand as a safe haven for funds or investments for smaller players.

The Stock Exchange of Thailand (SET) is the world’s worst-performing stock exchange this year as it continues to fall. Currently, down a whopping 13.45%

In the meantime, the Stock Exchange of Thailand (SET) has become the world’s worst-performing stock market. The scale of the losses, especially as they are in contrast to peers in Southeast Asia, is spooking investors in itself.

The index fell again substantially on Friday. It is presently down 13.45% for the year and 8.11% since January 1st.

In the meantime, the Thai Bond Market Association President Somjin Sornpaisarn has confirmed another ฿60 billion of bonds were sold off in the opening months of 2024. This followed a sell-off of ฿140 billion in 2023.

Basically, he expected the trend to continue with the yield gaps between Thai and American bonds making it a no-brainer for significant investors. This situation could well get worse under a Trump presidency.

On Friday, bond yields in New York rose on the news that the former President may be on his way back to the Oval Office.

Nevertheless, under Trump, US interest rates may come down faster.

Indeed this is what happened during his first term. Previously, under Trump, the US dollar fell 11% in the opening three years before the pandemic. However, the circumstances presently are quite different.

Of course, this would be good news for the Ministry of Finance which could see funds selectively flow back to Asia. Certainly, it would allow more scope to lower rates here.

Undoubtedly, the bugbear is inflation which is likely to be aggravated by further tariff measures as the United States under Trump turns further in on itself.

Hard to understand the fascination among Thai analysts with the country’s rate policy while ongoing capital flight has become a major issue since last year

Undoubtedly, it appears odd that Thai market watchers have been so fascinated with the Bank of Thailand’s interest rate policy amid what should be a more serious concern about capital flight.

The US Federal Reserve meanwhile is occupying minds in Bangkok.

It now appears probable that there will only be one rate cut stateside this year. It comes with the US economy persistently surprising analysts with its strength. In addition, with the US Presidential election going into gear, there will be a tendency for investors to hold capital in the United States.

On Thursday, Kobsak Pootrakool of the Federation of Thai Capital Market Organisations (FETCO) discussed US policy. At length, he was speaking at a forum in Bangkok organised by the Bond Market Association.

‘Views are split on the possibility of one or two Fed rate cuts this year. Economic figures signal it may not be easy for the Fed to cut rates twice in 2024,’ he explained. ‘It’s just a matter of time before the Fed starts actually cutting the US rates. When central banks around the world begin to trim rates in unison, the whole process could take 1.5-2 years to get the work done.’

A second Trump presidency is bound to bring a new dynamic in trade in Southeast Asia and across the wider Asia Pacific. In short, it will widen the divide

However, a Trump presidency will bring a new dynamic to Thailand’s economy.

The country’s reliance on China as its biggest trading partner and America as its largest export market means US trade policy is critical.

Certainly, it can be expected that Trump will widen trade tensions. In addition, he will accelerate the widening chasm between China and the United States. In turn, this will almost certainly further damage Thailand.

The current capital flight being seen is also linked to a changed world order.

This was instigated by Trump when he declared his trade war in 2017 and implemented tariffs in 2018. In turn, this triggered the ongoing decoupling process. In effect, a reversal of investment by Western firms in China.

Wall Street rallies for Trump

On Friday, the signals from Wall Street were not long in coming. The US dollar rose as investors anticipated a Trump administration Mark Two.

To many analysts that also means an ever fiercer trade war and tougher trade environment in Washington DC. Certainly, this may impact Chinese firms operating in Thailand which have offshored production.

On Thursday night, a vibrant Trump criticised Biden for not doing more to impose tariffs on cheap Chinese imports.

‘Wall Street indices have crept higher over the past hour, which could be taken as a sign that Trump made the better case, as we all know he is Wall Street-friendly,’ exclaimed Matt Simpson, a New York-based analyst at City Business General early on Friday morning.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Central bank holds interest rates. Economy will grow 2.6% in 2024 as Srettha pushes home ownership

Economy unlikely to grow in first quarter as Thai manufacturing crumbles. Hard choices ahead

New Finance Minister expected in April as economic malaise deepens with downgrades in GDP growth

Digital Wallet plan blown out of the water by corruption body on Tuesday warning of illegality

Economy is in troubled waters with fears for both exports and foreign tourism as 2023 winds down

Thailand faces an economic future of low growth despite Srettha’s plans because of a darker world

Another dip for the baht or are economic danger signals flashing for both Thailand and the world?

Bank of Thailand boss appears critical of the new government’s policy initiatives on the economy